Traditional payment methods like bank transfers and card payments are still available, yet most e-commerce businesses are offering more different payment methods. What are the methods of mobile payments? What are the effects of introducing mobile payments in Polish enterprises? Why should you use mobile payments? Why are mobile payments important in e-commerce from a business perspective? We will answer these questions and many more in today’s article!

According to a SW Research report done on behalf of Tpay, the most popular mobile payment methods in Poland are undoubtedly: BLIK and e-wallets such as PayPal, Apple Pay, Google Pay. This can be clearly seen in the chart below marked with an X on the graph.

From the entrepreneur’s perspective, it is also important to remember that companies aiming to expand overseas should take into account the preferences and habits of international users/customers.

China, for example, has a completely unique set of payment applications compared to Western European countries. PayPal’s service, on the other hand, is not as popular in Spain (only 6% of people use this type of payment) as in Germany, for example (32% of people use PayPal).

Mobile Payment Methods

1. BLIK

The possibilities offered by today’s technological solutions mean that we no longer need to carry a traditional wallet with payment cards. Using mobile devices such as a phone, tablet, or smart watch, we can make payments in both stationary and online stores. BLIK payments are making a furor in Poland. They are currently available in every Polish bank. In addition, the company is preparing solutions that will allow their customers to use BLIK abroad. When using BLIK, we do not need any additional applications or devices – all we need is a phone and a bank account. Importantly, the payment is very intuitive, you just need to enter a one-time, six-digit code generated in the bank’s mobile application in a specific place. The company is constantly making efforts to provide customers with the best possible solutions. It is constantly expanding its functionalities, such as the ability to remember a selected store or browser so that subsequent BLIK transactions are carried out as OneClick, that is, without rewriting the code, only by confirming the transaction on the phone. BLIK is already used by more than 10 million people in Poland. To better visualize this on a scale, it is worth comparing this number with the number of active banking mobile applications in Poland, which at the end of the fourth quarter of 2021, was around 21.6 million.

Effects of introducing BLIK payments

The ability to pay on the site using BLIK is an added value in the current e-commerce reality. The results presented by the Interia website are a perfect example. The portal reported that the exposure of BLIK payments on their website contributed strongly to their recent successes. In the process of paying bills, the Portal reported a 43% drop in shopping cart abandonment and a 20% higher retention of new users.

Another great example is leading premium fashion and home goods provider Breuninger, which noted that within three months of allowing customers to pay with BLIK, the store recorded a conversion increase of more than 21%. This payment method almost immediately became dominant, the store was able to more strongly engage customers in buying the product, thanks to which the number of abandoned shopping carts fell by as much as 24%. Data from PKO Bank Polski released earlier this year on last year’s Black Week, one of the biggest shopping holidays of the year, showed that nearly 63% of all online transactions were made using BLIK.

2. Mobile wallets

Competing with BLIK and the digital alternative to the wallet kept in your pocket are mobile wallets. The market continues to grow, allowing users to take advantage of multiple solutions. PayPal alone boasts 350 million users in 190 countries around the world (in Poland alone there are already more than one and a half million such users). Apple Pay, on the other hand, is a system that allows payments on Apple’s mobile devices such as iPhones, iPads and Apple Watches, while Google Pay allows payments on Android devices. The mentioned methods work with credit and debit cards, and allow both contactless and remote payments.

Less common examples of mobile wallets:

- Garmin Pay

- Fitbit Pay

- SwatchPAY!

- Xiaomi Pay

Why are mobile payments becoming more popular?

The increased popularity of mobile wallets in Poland is due to several factors:

- Adding a payment card to an electronic wallet is very simple – just take a picture of it, and the device itself will remember the card number and appearance. All that remains is for us to enter the card’s expiration date and CVC/ CVV code, and verify the card with a code received by SMS from the bank.

- Security – Apple uses what is known as tokenization. This means that when processing payments, card and account details are not sent, and are replaced by a randomly generated number, known as a token. FaceID, TouchID, or a screen lock on the device are also mandatory security features. With BLIK, on the other hand, a unique code is generated for each transaction, which cannot be used again and requires confirmation in the bank’s mobile app.

- Constantly improving services – especially from the perspective of security methods. Today’s solutions minimize the risk of losing funds and make a strong case for not just trying, but using this type of payment on a regular basis.

Mobile payments in Poland

According to the report “NetB@nk. Internet and Mobile Banking, Non-Cash Payments” at the end of Q1 2022, more than 17.5 million Poles were active users of banking mobile applications. This is an increase of as much as 21% compared to Q1 2021. Currently, more than 80% of online banking customers make cashless payments using mobile apps.

The Polish payments market stands out in terms of the adaptation of innovative solutions. Poles are quickly adopting technological innovations such as proximity and mobile payments – as evidenced by the higher rate of use of various forms of mobile payments offered by banks compared to most Central and Eastern European countries.

According to the NBP report – the main driving force behind the changes in Poles’ payment behavior has been the coronavirus pandemic. It has affected both payment methods in stationery stores and the development of the e-commerce segment. The need to stay at home and the long-term closure of some stores and service outlets also changed the structure of consumer spending, which was also not insignificant for the preferred form of payment.

Feature Curiosity

The SW Research report also reveals that for specific products and services, there is a clear trend in making payments by specific methods. Surprisingly, this is mainly due to a sense of security and the scale of the transaction. BLIK is preferred when buying public transportation tickets, ordering subscriptions, renting a motor scooter or bicycle, as well as when betting on bookmaking. Online transfer (Pay-By-Link) is especially preferred when buying event tickets, furniture, furnishings, games, movies, or books. Therefore, if you plan to sell any of the above-mentioned products or services, you should take care of the appropriate payment method.

Mobile payment security

There are a number of technologies, such as encryption, SSL, and PCI DDS, that make mobile payments often more secure than traditional card payments, for example, thanks to blockchain and biometric authentication. We mentioned tokenization earlier – be aware that the process of tokenizing a card is as secure as a transfer sent from online banking, or online card payment with 3D Secure service – even if the user loses the phone/smartwatch or worse, it is stolen, there is no need to worry in this situation. None of the digital wallets store the card number in the device’s memory. This data is also not shared with merchants when making a mobile payment – only the virtual card number, or token, is used for these purposes. No amount of malware or virus will therefore be able to intercept our card data. Without exception, contactless transactions must be confirmed by biometric authentication such as a fingerprint or facial scan.

Why are mobile payments important in e-commerce?

We have focused on the security aspect of mobile payments, but that is not everything. Providing your customers with mobile payment options brings a number of other advantages from a business perspective. Mobile sales continue to grow and outpace desktop sales. By optimizing the entire customer journey, including payment – you will win. Why?

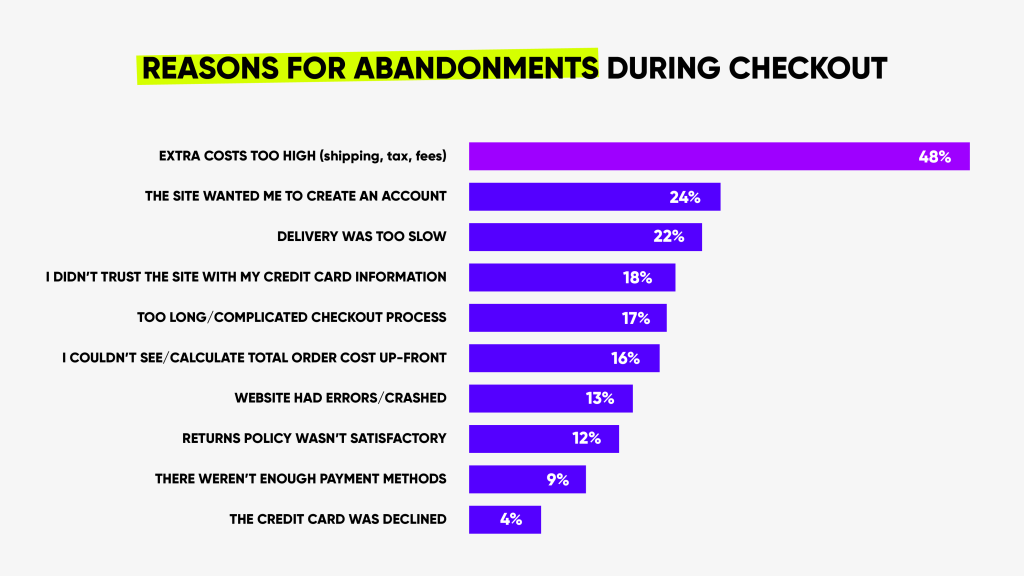

Because by offering a wide range of mobile payments, you can cater to the widest possible range of customer preferences, which means more conversions, sales, and revenue. According to data from ECC Koln, an e-commerce consulting firm, as many as 75% of e-consumers, consider the payment process crucial. Merchants who make popular payment methods available care about the consumer experience. Data from Baymard institute shows us information regarding the average shopping cart abandonment rate – 68%. At the same time, the study “Reasons for Cart Abandonment – Why 68% of Users Abandon Their Cart” shows that the complicated transaction process and the lack of a sufficient number of payment methods are among the top ten most common reasons for cart abandonment.

Mobile payments are most popular among young people. According to a Gemius study, as many as 92% of respondents between the ages of 14 and 24 use mobile payments. This result is very high, which confirms the belief that this group is the future of this form of payment. For this group of users, e-commerce payment methods particularly influence their brand perception and propensity for repeat visits and can play a decisive role in their decision to make further purchases and recommendations. Users want to be able to choose their favorite payment method. Without giving them such an option, you are very likely to lose sales opportunities.

Conclusion

The data leaves no doubt – in order to meet the expectations of customers (users), a merchant should allow them to pay for their orders in the way they prefer. There are measurable benefits of offering multiple mobile payment options: less abandoned shopping carts, more satisfied customers, and a higher level of security, so the e-commerce industry needs to know user preferences and available solutions in the mobile payment market. Keep in mind that a big problem with mobile shopping is that users tend to be much less engaged than when using a desktop computer. Users shop using their cell phones while commuting, watching TV, or even waiting in line, which is why it is so important to make making payments easy and enjoyable. Following the statement “time is money,” mobile payments eliminate the need to enter credit/debit card information when making payments and thus save the user time and nerves.

If you want to successfully run your e-commerce business – be sure to do mobile transactions and subscribe to our onepager – E-commerce insights, where every month we provide a small summary of news, reports, deals, and much more from the e-commerce industry!